As an options trader, you want to maximize your returns while minimizing risk. One important technique for reducing risk and increasing profit potential is using breakout strategies: strategies designed to identify when prices are about to move quickly in a particular direction and then capitalize on that movement.

In this article, we’ll explore why breakout strategies can benefit options traders and how they can give you an edge in the markets. We’ll discuss what makes breakouts effective, different ways to initiate these trades, and helpful tips for improving their success rate. By the end of this article, you should have all the information needed to begin incorporating breakouts into your trading approach.

Defining Breakout Strategies

Breakout strategies are powerful techniques used in trading to identify when a security’s price is poised to either move higher or lower after breaking through a significant level of support or resistance. These strategies are based on the idea that once a security’s price breaks through a critical level, it will continue to move in that direction.

One of the critical advantages of breakout strategies is that they enable traders to spot trends and capitalize on them before others do. However, they require significant analysis and skill to execute effectively. With technical analysis tools such as charts, volume, and moving averages, traders can identify the ideal entry and exit points to maximize their profits. In essence, breakout strategies are essential for traders looking to capitalize on market volatility and secure their financial future.

Analyzing Market Conditions

When it comes to recognizing potential breakout patterns, a few key indicators can help traders identify when prices are likely to move. These include higher-than-average trading volume, divergences between technical indicators such as moving averages and price action, and chart patterns like head and shoulders or triangles. By looking for these signs of strength or weakness in the market, traders can know early when a breakout could be imminent.

Additionally, options traders should look for signals from news sources about upcoming events that could impact the markets. It could include earnings announcements or central bank decisions. By being aware of these events beforehand, options traders can prepare their trades accordingly and potentially increase their profits.

Setting Up Trades

When it comes to setting up trades, proper risk management is essential. Options traders should always remember that these strategies carry high risks due to their inherent volatility. Ensuring that each position has an acceptable risk level concerning the potential returns is crucial.

To help manage risk and maximize profits, options traders can use strategies such as stop-loss orders or hedging. Stop-loss orders enable traders to automatically close a position when it drops below a specific price point, which helps protect against significant losses if the breakout fails. Hedging helps options traders minimize their exposure to risk by taking both long and short positions on the same security at the same time.

Establishing Parameters

Once a potential breakout is identified and the appropriate trade setup is in place, traders must decide when to enter and exit the position. It requires careful consideration of the security’s current price action, volume, and technical indicators. Entering too early or late can lead to losses, so it is essential to be patient and wait for the ideal moment to initiate a trade.

Options traders should also consider when to exit a position once it has been opened. Taking profits too early could limit returns while waiting too long could result in unexpected losses. Establishing predetermined targets before entering a trade will help options traders establish an optimal point to exit.

Tracking Results

Options traders need to track and analyze their results. It can help identify which aspects of the strategy are working well and which need adjustment. Analyzing data such as average profits, winning percentages, and other vital metrics provides insights into strategies’ performance over time. With this information, options traders can adjust their strategies to become more successful in the long run.

Additionally, options traders should monitor and analyze macroeconomic news that could affect the markets. By understanding how different economic events could impact their positions, traders can make informed decisions about when to enter or exit trades for maximum returns.

Reacting Quickly

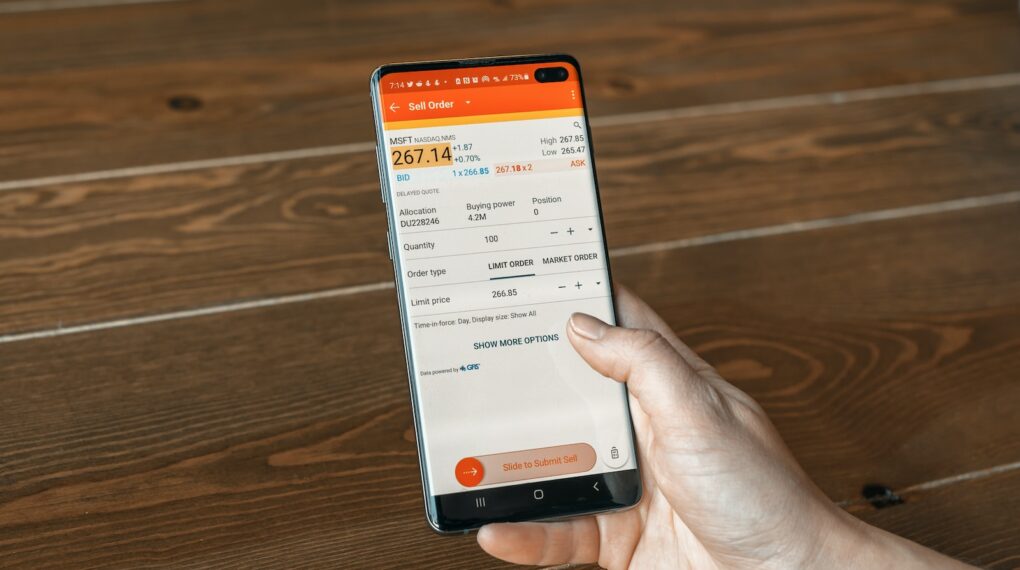

Ultimately, options traders must be able to react quickly to changing market conditions. Technology is essential for this, as it can provide real-time information that enables traders to make informed decisions in fast-moving markets. Platforms such as Saxo Bank and TradeStation offer sophisticated analytical tools and order types that help give options traders the edge they need to stay ahead of the competition.

By leveraging technology and staying aware of news events, options traders can increase their chances of success by quickly responding to market changes. It will enable them to potentially maximize profits while limiting losses. If traders are unsure about where to start when it comes to trading, they can consult trading guides online that will explore financial terminology, analysis methods, and strategies that can be used.