Facing financial difficulties can be overwhelming, but there are ways to manage the stress and regain stability. By comparing different loan options and taking proactive steps to reduce debt, you can navigate these challenges effectively. Understanding your financial situation is the first step towards making informed decisions. In today’s economic climate, many people find themselves…

The allure of a gleaming new car, fresh off the lot, is undeniable. That new car smell, the latest technology, and the promise of reliability are tempting. But before you sign on the dotted line, it’s essential to take a step back and consider the financial implications. Buying a new car is a significant investment,…

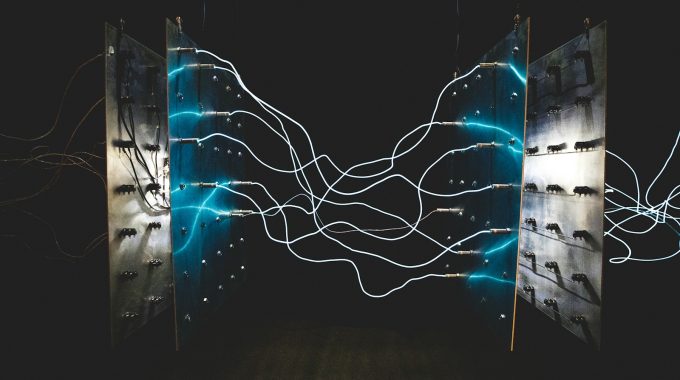

Reduce electricity costs by conducting an energy audit to identify inefficiencies. Upgrade to energy-efficient appliances, switch to LED lighting, and install programmable thermostats. Utilize intelligent power strips, insulate your home, and consider alternative energy sources like solar panels. Regularly monitor usage and adopt energy-saving habits for long-term savings. Introduction to Reducing Electricity Costs Saving on…

Every endeavor you embark upon requires simplicity. Common sense and staying grounded ensures that you think clearly and make informed choices. Continue reading this article for some easy ideas, which will help you to boost your investment portfolio by using the tips and tricks that experts use in their own financial adventures. The best time-proven…

Debt is a growing issue that affects millions of people, and California is no exception. The high cost of living and economic challenges have led many Californians into financial difficulties. This is particularly true for the Hispanic community in California, who often face unique economic hurdles. Therefore, finding effective liability reduction strategies is crucial to…